8 Things to Consider When Calculating International Moving Costs – Part 2

- Asian Tigers Group

-

Home » News » Industry News » 8 Things to Consider When Calculating International Moving Costs – Part 2

Further Discussion on Calculating International Moving Costs

Thinking of moving overseas but not sure if you’ve considered all the costs of moving? Calculating the costs of moving should be done carefully and meticulously, but losing track of things is normal. We have talked about the first four things in the previous blog: 8 Things to Consider When Calculating International Moving Costs – Part 1. Let’s talk about the remaining four things in this blog.

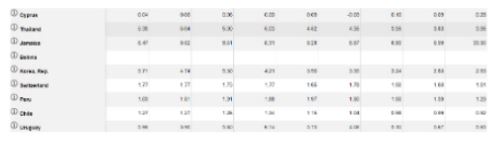

5. Customs duty charges and taxes

Depending on the country you move to, customs duties and taxes may become a surprise expense. They differ drastically based on the country and the circumstances of your move. However, they also depend on the value of your goods. Moving between countries in the EU, for example, might be basic free of duty charges, while moving from the US to France will incur heavy-duty charges.

6. Housing costs

As your housing costs are likely to be your single most considerable outlay, you will also likely be required to pay taxes and fees in the country where you’re moving. Property tax is generally higher in cities and urban areas than in rural areas, but the exact terms differ from country to country. Some, such as the UK, where stamp duty is required to pay yearly, might not even have property taxes. Mortgage or rent isn’t the only expense of purchasing or renting. It would be best to plan for the utilities you will need, both in terms of set-up costs and monthly costs for the time it takes you to get established.

7. Visa fees

Moving to another country for work and study generally requires a visa, though this can vary depending on the region. Someone moving from one country to another in the EU might get a free visa, while a person moving from outside the EU would get charged. The visa fees depend on both countries and the type of visa. For example, visas in the UK can cost over $1,300. Remember that visa fees are a recurring cost and must be paid every time you renew your visa, so adjust your budget accordingly.

8. Asset transfer fees

Asset transfer fee is the cost of bank transfers for sending funds overseas. Still, it can also include the cost of transferring business assets should you decide to relocate your business. Your budget should consist of the exchange rate and additional fees that you might incur depending on how much money you are converting. These can be obtained from most financial entities that deal in large overseas transfers. Additionally, consult your bank on your options to minimize this cost.

Consult end-to-end experts on moving internationally

Budgeting can be an arduous task, especially if you are inexperienced. Making mistakes can incur extra fines, and going over budget is a widespread occurrence, especially in your first move. If you need an expert who can help you from the start to finish of your plans, Asian Tigers has the experience to help you with both the move itself and the planning. We’re happy to provide subject matter expertise when moving internationally, something we’ve done with clients countless times over the years.

If you would like assistance with shipping or relocation support, contact your local Asian Tigers office or reach out to us via our online contact us.

If you found this article interesting, you might also be interested in taking a look at 8 Things to Consider When Calculating International Moving Costs -Part 1; Timing Your Move – Peak vs. Non-Peak and Moving During COVID: Facts and Tips.